Since 1978, boards, CEOs, family owners, and entrepreneurs have turned to CD&R as their trusted partner to help businesses grow profitably.

CD&R works to make companies grow and prosper. Often we partner with families, founders, or corporate owners. The vast majority of the value we create results from strong collaborations with management to spur operational performance improvements by accelerating growth strategies, injecting new talent, and boosting productivity. The Firm stands on a reputation for problem-solving, managing complex transactions, and always doing what we say we will do.

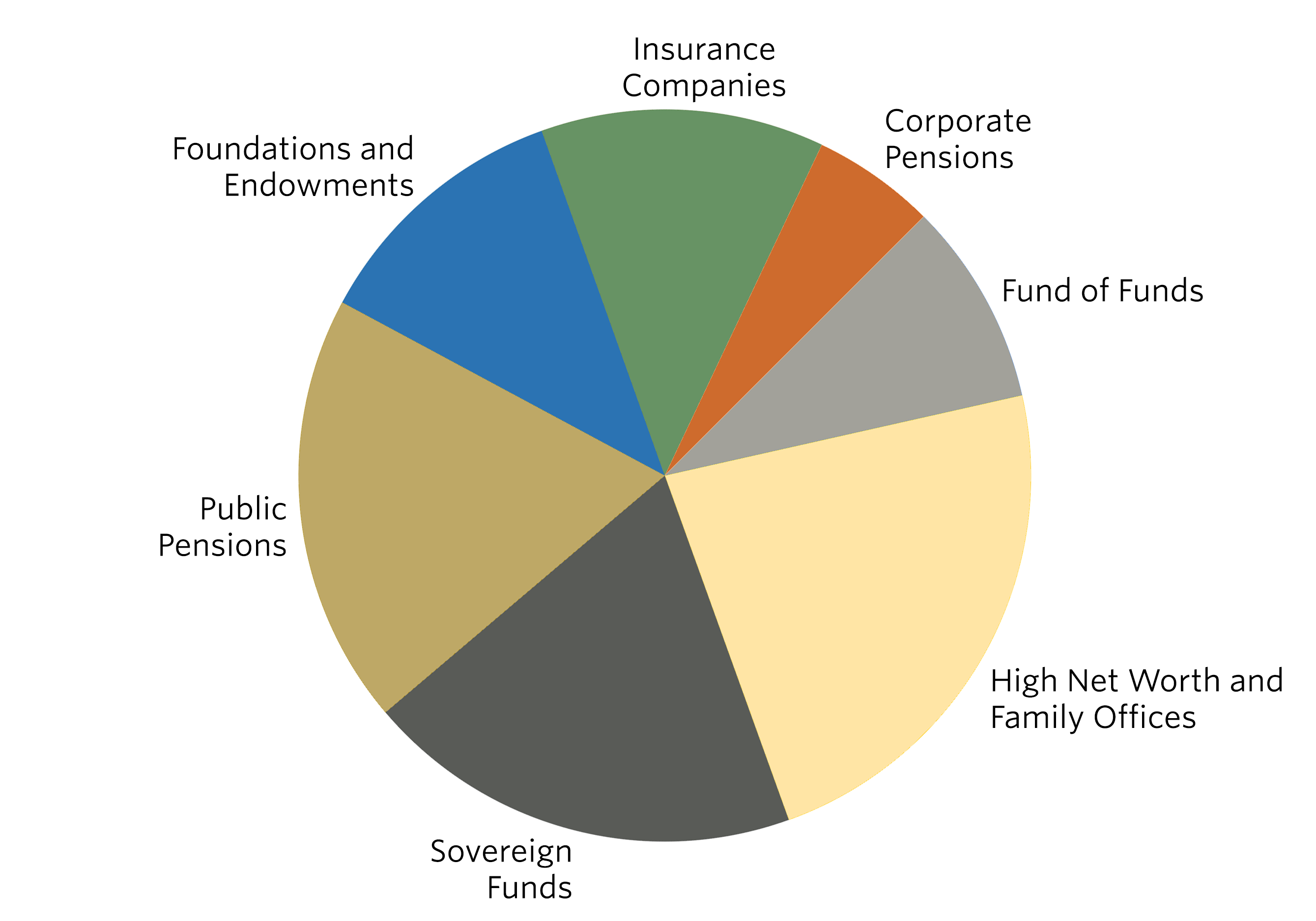

![Pie chart showing Investors by Geography. Sections include: North America (43.36%), Asia (20.67%), Europe [excluding U.K.] (15.51%), U.K. (4.68%), Middle East (11.04%), and Latin America (4.74%).](/sites/default/files/charts/investor_by_geography_23.png)